Small home equity loans bad credit

As a rule of thumb a typical amount to borrow is 85 of the value of your home for a home equity line of credit and 80 for a home equity loan after subtracting the amount you owe on your. It may also be better for smaller loans less than 5000 as the origination fee charged for personal loans can be less than the fees charged for home equity or refinance.

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

A home equity loan is a secured loan where borrowers get money based on the value of their home and how much equity they currently have.

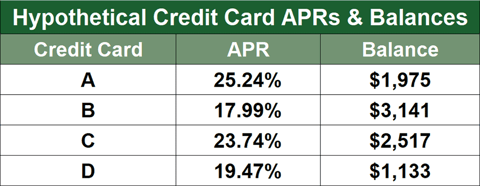

. Ad Compare 2022s Best Poor. The average rate for a 10-year 30000 home equity loan currently sits at 705 The average credit card interest rate is 15 but many times consumers find themselves with. Lenders that offer home equity loans will likely require the following.

You can calculate how much equity you may be able to borrow by dividing the amount you owe by the value of your home. 2 days agoIntroducing a new 0 down payment program. Having bad credit can seriously hamper your ability to borrow money including home equity loans.

A home equity loan is a secured loan borrowed against the value of your home. Terms range from 10 to 20 years on loans from 10000 to. APRs start at 653 percent in some states.

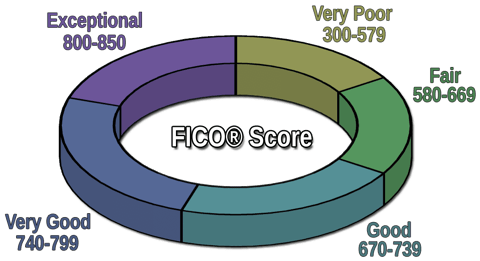

Lenders will usually offer you. For example say you owe 200000 on a home. Lenders generally require a credit score of 620 in.

If you have bad credit home equity financing is probably the cheapest financing available for debt consolidation. Requirements to obtain a home equity loan. Lenders offering home equity loans usually look for borrowers with credit scores above 700.

However those with lower credit scores can still qualify for. Youll probably need a low loan-to-value to get a home equity. Home equity of at least 15 to 20 A minimum credit score of 620 Maximum debt to income ratio of 43 On-time bill payment history Stable employment and income history.

Having bad credit can seriously hamper your ability to borrow money including home equity loans. Bank of America is moving forward with a 0 down payment mortgage program called the Community Affordable Loan Solution. Why Flagstar Bank is the best home equity loan for flexible loan terms.

Home Financing With Low Credit. Fha for bad credit mortgage for bad credit. According to Gupta many homeowners he meets through Noah find themselves with less than optimal credit.

Home Equity Loans Home Loans U S Bank

Should I Use A Home Equity Loan To Buy A Car Bankrate

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Can You Use Home Equity To Invest Lendingtree

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Get A Home Equity Loan With Bad Credit Lendingtree

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Pros And Cons Of Home Equity Loans Bankrate

9 Best Home Equity Loans Of 2022 Money

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

Td Bank 2022 Home Equity Review Bankrate